Trading is an exciting field that offers numerous opportunities for financial growth. If you have already grasped the basics of trading and wish to take it to the next level, mastering effective intermediate strategies is essential. These strategies will allow you to optimize your investments, manage risks more sophisticatedly, and increase your potential returns. In this article, we will explore five essential intermediate trading strategies and introduce a valuable tool to maximize your gains: our compound interest calculator.

1. Advanced Technical Analysis

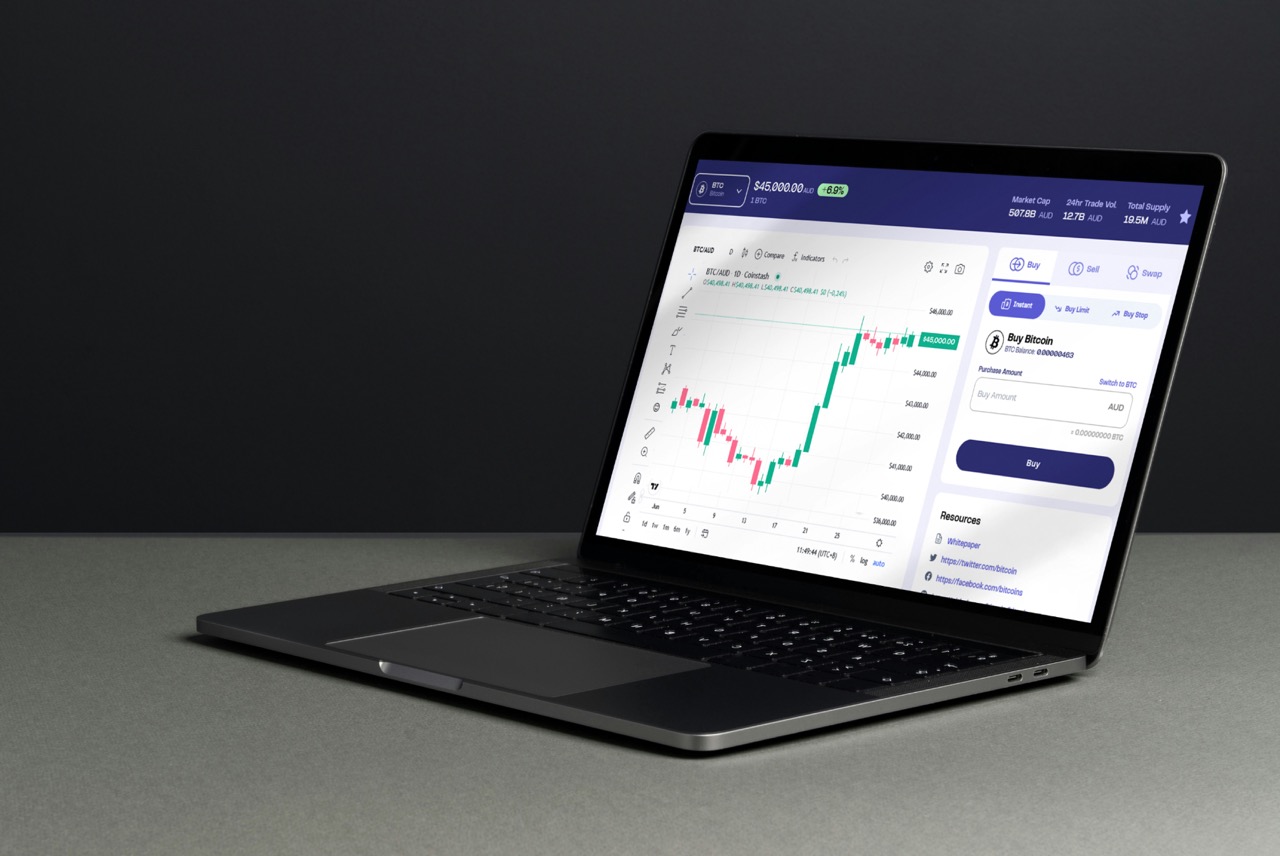

Technical analysis is at the heart of trading, but to advance to an intermediate level, it is crucial to master more advanced tools and indicators. These include:

- Chart Patterns: Learn to identify configurations such as triangles, head and shoulders, or flags, which can signal trend reversals or continuations.

- Oscillator Indicators: Use tools like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to assess the strength and direction of price movements.

- Multiple Moving Averages: Combine different periods of moving averages to identify crossover signals and refine your entry and exit points.

Mastering these aspects of technical analysis will enable you to make more informed trading decisions and better anticipate market movements.

2. Advanced Risk Management

Risk management is essential for any trader, but at an intermediate level, it is important to adopt more sophisticated techniques:

- Position Sizing: Determine the optimal size of your positions based on market volatility and your risk tolerance.

- Trailing Stops: Use stop orders that move with the price to protect your profits while allowing your positions to evolve favorably.

- Diversification: Spread your investments across different assets or sectors to reduce the impact of a loss on your overall portfolio.

Rigorous risk management will help you preserve your capital and navigate more confidently through volatile markets.

3. Position Trading Strategies

Position trading involves holding positions over an extended period, typically several weeks to months. This strategy relies on identifying long-term trends and requires:

- Macroeconomic Analysis: Understand the economic and geopolitical factors that influence the markets.

- Increased Patience: Be prepared to maintain your positions even during short-term fluctuations.

- Clear Objectives: Define entry and exit points based on solid fundamental and technical analyses.

Position trading allows you to capitalize on major market trends while minimizing the impact of daily variations.

4. News-Based Trading (News Trading)

The market often reacts significantly to economic, political, or corporate news. News-based trading involves:

- Monitoring Important Announcements: Stay informed about reports on employment, interest rate decisions, company earnings, etc.

- Analyzing Potential Impact: Evaluate how a news event might influence the prices of the assets you are trading.

- Reacting Quickly: Develop the ability to make swift decisions to take advantage of price movements triggered by news.

This strategy can be highly lucrative but requires constant vigilance and the ability to respond quickly to information.

5. Using Options for Hedging and Speculation

Options are powerful financial instruments that offer additional flexibility in your trading strategies. At an intermediate level, you can use options to:

- Hedging: Protect your existing positions against adverse market movements by using put options.

- Speculation: Amplify your potential gains by using call options when you anticipate price increases.

- Combined Strategies: Implement complex option combinations, such as spreads or straddles, to benefit from specific market movements.

Using options requires a thorough understanding of their functionality and valuation, but they can significantly enhance your trading strategies.

Maximize Your Gains with Our Compound Interest Calculator

To optimize your investments and fully leverage these intermediate trading strategies, it is essential to understand the impact of compound interest on your long-term gains. Our Compound Interest Calculator is an indispensable tool that allows you to:

- Simulate Different Investment Scenarios: Visualize how your investments can grow based on varying interest rates and investment periods.

- Plan Your Financial Goals: Set clear objectives and track your progress with accurate projections.

- Understand the Importance of Reinvestment: See how reinvesting your earnings can accelerate the growth of your portfolio.

By integrating our compound interest calculator into your trading strategy, you can make informed decisions and maximize your long-term returns.

Conclusion

Advancing to an intermediate level in trading requires mastering more sophisticated strategies and rigorously managing your investments. By adopting advanced technical analysis, improved risk management, position trading strategies, news-based trading, and the use of options, you will be better equipped to navigate complex financial markets. Additionally, by using our compound interest calculator, you can optimize your gains and achieve your financial goals more quickly. Invest in your education and utilize the right tools to transform your trading skills and secure your financial future.